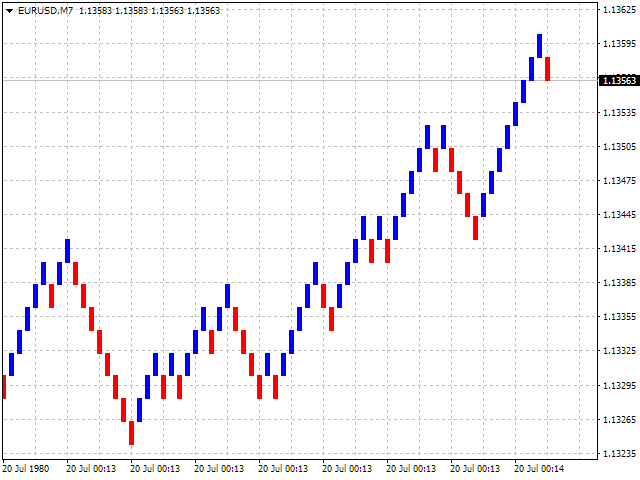

Renko Bars Indikator

Codebreaker v8 iso download. However, doing assignments with academic excellence is not an easy task. Im thinking about getting showtime for homeland.

What are Renko bars? Difference between Median Renko and Regular Renko bars. Follow me on Twitter. Renko chart software for trading Indian stocks https.

CM_Renko Overlay Bars V1 Overlays Renko Bars on Regular Price Bars. ***Color of Renko Open and Close Lines Change Based on Direction. Default Renko plot is based on. Look Back period adjustable in Inputs Tab.

If you Choose to use 'Traditional' Renko bars and pick the Size of the Renko Bars the please read below. Value in Input Tab is multiplied by.001 (To work on Forex) 1 = 10 pips on - 1 X.001 =.001 or 10 Pips 10 =.01 or 100 Pips 1000 = 1 point to the left of decimal. 1 Point in Stocks etc. 10000 = 10 Points on Stocks etc. ***V2 will fix this issue. This is amazing! It was actually my MSc research paper.

I have done my researches on Matlab and I am so happy to find it on a real time platform. Based on my research, mixing a movement based to spot the trend and a time based to spot patterns is a killing machine. Just one thing, on my research, I was working on fixed number but took into account the rounded numbers. If 50 pips: 1.2500,1.2450,1.2400,1.2350. Do you think this would be possible to do on this platform? By the way ( on G8 cross), you have 70% chance of a upward renkobar to be followed by an upward renko bar.

73% if the renko bar goes with the MA20 trend. The opposite is also true. However, the key is to get in retracement rather than break outs. I hope this helps. Thanks for the comment.and the information you provided. If you would.Let everyone else know what a G8 Cross is!!!

Maska komara iz bumagi na golove youtube. I've decided to try the line for dry and damaged hair with argan oil.

Regarding the 70% chance of upward Renko followed by upward Renko Did you take in to account the 'Amount' of the Renko Bar? Were you using a ATR based Renko as far as the size of the Renko? And please define with the MA20. Is the MA20 you tested a SMA 20 or EMA 20?

Did you define the MA20 Trend meaning the current MA20 is Higher than the MA20 1 bar ago.so Upward Slope? And did you test this on Multiple Timeframes, or just Daily? Thanks again for your insights. I have access to all areas of Daily FX and I just looked and the charts I saw were Daily FX using the TradingView Widget to embed charts. Those can't have custom indicators. However you can take a snapshot of a chart on TradingView and post anywhere.the chart just wouldn't update in real time.it would be like a screenshot. If where ever your posting the chart at doesn't automatically embed the link from TradingView then you can always take a screenshot and use many available services to embed the chart in a blog or wherever your trying to post it at.

Do you really have to consider the time or volume in your trades, or is it also possible to trade based on the price changes only? This question is the foundation of the Renko chart. Renko chart is invented by Japanese traders too.

On a Renko chart, time and volume have no role and only the price changes are considered. Renko candlesticks look like small bricks or boxes.

They have no upper or lower shadows. We can change the box size in the Renko charts. A new box will appear on the chart only when a special level of price change occurs. When the box size is set to a smaller settings, then new boxes come faster, but when the size is set to a higher settings, then a larger price change needed, in order to appear a new box on the chart. The smaller the size, the higher number of boxes, and so more details of the price changes. The larger the size, the lower number of boxes and less details from the small price changes and noises. Therefore, the first and most important feature of the Renko charts is eliminating the markets noise.